HOME MORTGAGES

At Mi BANK we offer a variety of mortgage financing options to help make your dream of homeownership a reality. We provide a simple process with a high level of both trust and service to make certain you get the right loan, a competitive rate, and exceptional service that will continue long after your loan is closed.

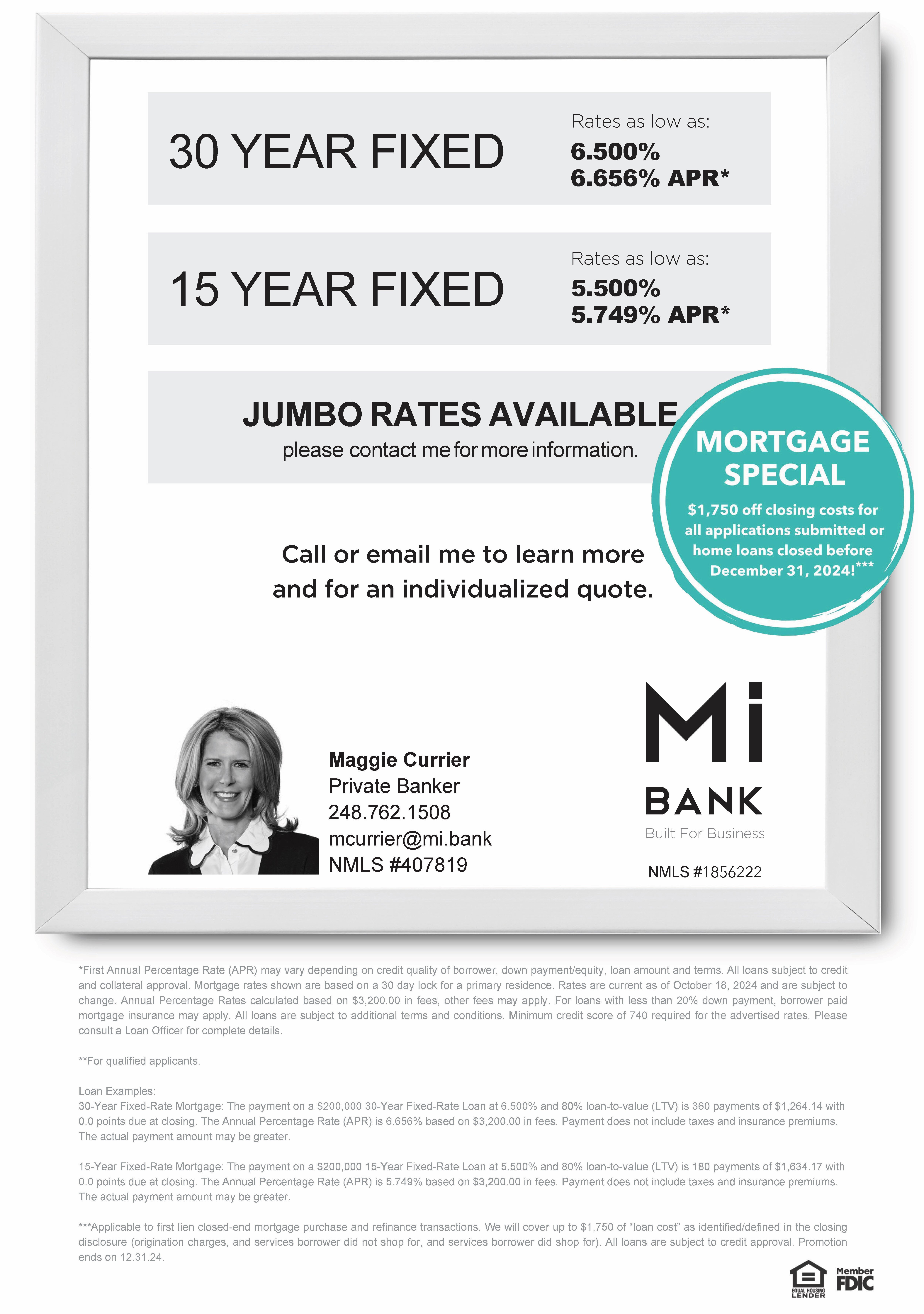

Fixed Rate Mortgages

- The traditional fixed rate mortgage loan is the most popular loan program

- May be used to purchase a new home, refinance your primary resident, second home, vacation home or investment property

- The fixed rate and payment throughout the life of the loan provide peace of mind

Adjustable Rate Mortgages (ARMS)

- ARM choices include 5 year, 7 year and a 10 year term

- May be used to purchase a new home, refinance your primary resident, second home, vacation home or investment property

- Up to 30 year term amortization

Pre-Qualifications

Win the deal in this competitive purchase market with a pre-qualification from Mi BANK. We love working with prospective home buyers to determine the loan amount they qualify, what costs, fees and of course what payment to expect. We promise to work hard to make the process transparent, simple and yes enjoyable!

Closing day should create a celebration not a need for a vacation! Mi BANK’s pre-qualification are quick and completely free. Contact your banker today to set out on the path to the American Dream of homeownership.